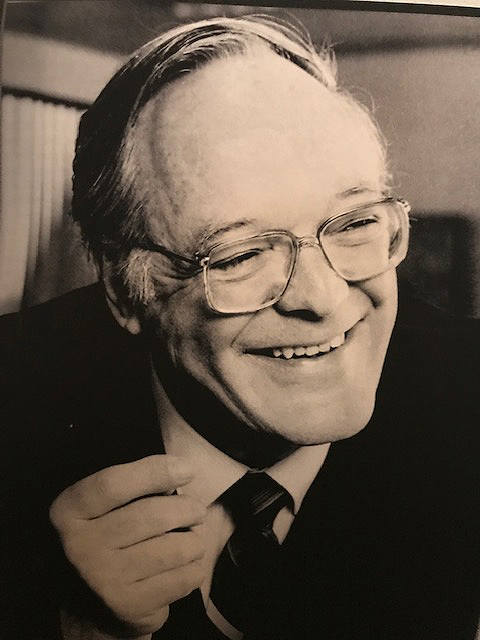

John B. Neff (Bus ’55) applied his investment savvy to philanthropic causes

By Laurie B. Davis

The late John B. Neff (Bus ’55) was very grateful for his University of Toledo education says his daughter, Lisa Neff Ryave. It was at UToledo that the late professor Sidney M. Robbins introduced Neff to the world of finance, a field in which Neff built a remarkably successful career.

Neff made a name for himself in the investment industry as a contrarian, value investor who chose stocks that had fallen out of favor with most other investors. As manager of the Vanguard Windsor mutual fund, Neff became one of his era’s most successful fund managers, beating the Standard & Poor’s 500 in 23 of his 31 years at Wellington Management Co.Neff is considered one of the top five, all-time mutual fund managers among an elite group of four other well-known investors: Sir John Templeton, Benjamin Graham, T. Rowe Price Jr., and Peter Lynch. According to this source, the common denominator with these five investors was that each had an unconventional approach to playing the market.

UToledo also is where Neff met Lillian Tulak. Together, they had a 63-year marriage and three children — sons, Stephen and Patrick, and their daughter, Lisa. Born Sept. 19, 1931, John Neff died June 4, after a long battle with Alzheimer’s. His wife, Lillian, preceded him in death in 2017, and their son Patrick died in 1985.

Finance and family topped Neff’s list of priorities. Neff Ryave says her father always attended her dance recitals and her brothers’ sports games, adding, “he was always at dinner.” But John Neff was never too far from the stock market. “I know he had his Wall Street Journal with him, and he’d put it down while I would do my dance,” she says. “As soon as I was done and the next person came on, he would go back to reading.”

After graduating from UToledo, Neff hitchhiked to New York City to seek employment, but Wall Street rejected him. “He was shocked that nobody was interested in him,” says Neff Ryave. “He had a very Midwestern attitude that maybe didn’t go over well in New York,” she adds. “My mother was thrilled he was rejected because she had no intention of moving to New York City.” He instead took a job as a securities analyst at National City Bank in Cleveland. Neff was later offered a position at Wellington in Philadelphia. “When he got the job in Pennsylvania, he knew he was on his way,” says Neff Ryave.

Setting a new course at UToledo

Ronald Greller (Bus ’74), a UToledo alumnus who lives in Philadelphia, befriended Neff at alumni events. When the events were in New York, they often would ride there together, giving them an opportunity to talk. “He was very soft-spoken,” says Greller. “He was a down-to-earth individual, and not at all boastful.”

Greller says that Neff had a genuine love for UToledo and his generosity was a testament to that. John and Lillian Neff’s first gift of $500,000 established the Neff Scholars Jump Start Program, which continues to support incoming students in the College of Business and Innovation. In 2003, the Neffs brought to UToledo the John B. and Lillian Neff Trading Floor, an interactive lab connecting students to the world stock exchanges. And in 2007, the Neffs supported the business college with a $4 million gift, the largest gift the college had ever received. It would fund a faculty chair in finance and programs to serve future generations of students.

Neff also shared his professional expertise with students. Gene Collins (Bus ’68, ’71), a former University of Toledo Foundation board member, met Neff through Thomas Gutteridge, dean of the former College of Business Administration. Collins was serving as the Executive-in-Residence for the Department of Finance. In 2006, the College created the Student Managed Portfolio with $1 million in University of Toledo Foundation funds to kickstart the program. The purpose was to give students hands-on money management and learn the business and science of investing.

Collins and Neff designed the course with practical ways for students to study stocks and choose the best for the portfolio. Neff would periodically review the portfolio and comment on its structure, says Collins. “The course was not as focused on theory, but it was more about, could you apply the theory and make it work.”

The student-managed portfolio performed very successfully, says Collins. “That’s a tribute to John.” Collins says Neff also talked with students. “He shared his mindset for understanding stocks and shared his methodology; he passed that on to the next generation. I will never forget his impact,” says Collins.

The value of philanthropy

Jeffery Stegeman (Bus ’09) of Toledo says he’s taken everything he learned in his business courses at UToledo and applied them to his career as a portfolio strategist for Key Private Bank, and that includes the Student Managed Portfolio class. “You can’t have that experience at every university,” says Stegeman, “to manage real money in a collegial investment environment, working with other students as co-managers of the portfolio.

Stegeman says he never got the chance to meet John Neff, but has met some of his family members. “Their multi-generational commitment to philanthropy at UToledo illustrates what giving back can do for future students and their careers,” he adds.

Neff Ryave says her father was very proud of being able to provide UToledo finance students with the tools and experiences that set them up for success. He also took great pride in increasing the University of Pennsylvania’s endowment to an Ivy League level. Neff managed the endowment in his spare time, free of charge, raising it from millions to billions. He also was proud of building and improving Vanguard.

When he wasn’t working, Neff might have been found playing tennis, his sport of choice, and one he was quite good at, says Neff Ryave. In 1984, the Neff family moved to a newer home. “Me and my mom went out to look at houses, and the only requirement that my dad had was that there had to be a tennis court. First of all, there weren’t that many homes with tennis courts, so we said, what if you don’t like the house? And he told us as long as we liked it, he would like it.”

Neff Ryave says her father’s colleagues and friends, some of whom worked at Vanguard and Wellington, would play tennis at their home. “Some of these guys who didn’t know him [her father] that well were intimidated by him. But that’s how they ended up bonding, through tennis,” says Neff Ryave. What many of them discovered was that this legendary investor also was a soft-spoken, down-to-earth, family man who could beat them in tennis.

John Neff is survived by his son, Stephen, daughter, Lisa, five grandchildren and three great-grandchildren.